A Comprehensive Overview to Cars And Truck Funding Conveniences

Browsing the world of auto financing can be a strategic step for individuals looking for to get a vehicle. The benefits that go along with very carefully intended financing alternatives prolong past plain convenience; they can significantly affect one's economic wellness and long-lasting objectives. From lower rates of interest to the opportunity of driving home a brand-new car, the advantages are various and varied. Understanding the intricacies of car financing advantages can pave the way for an extra enlightened decision-making process that straightens with your monetary goals.

Advantages of Automobile Funding

When taking into consideration the advantages of car financing, potential purchasers can leverage adaptable payment alternatives and access to a bigger series of vehicles than with outright acquisitions. One of the primary advantages of auto funding is the capacity to spread the cost of an automobile with time with monthly installations, making it more cost effective for people that might not have the funds offered for an outright acquisition. 2023 ford bronco near Minooka. This adaptability in payment alternatives allows buyers to choose a plan that lines up with their financial scenario, whether they like a shorter loan term with greater regular monthly repayments or a longer payment period with reduced monthly costs

Moreover, car funding supplies accessibility to a broader choice of vehicles. The selection of lorries available for financing enables purchasers to discover a vehicle that fulfills their details requirements and choices, improving their overall driving experience.

Lower Rate Of Interest

Taking advantage of lower interest rates is a crucial benefit of car financing, permitting purchasers to minimize overall expenses and make their vehicle acquisition much more monetarily viable (ford finance morris). Lower rate of interest cause decreased month-to-month settlements, decreasing the financial concern on buyers throughout the funding term. This not only makes buying a vehicle extra cost effective however likewise makes it possible for purchasers to potentially manage a higher-priced auto or decide for far better functions within their budget

Furthermore, reduced rates of interest translate into savings over the life of the finance. By safeguarding a reduced rate, purchasers can conserve hundreds or perhaps thousands of dollars in rate of interest settlements. This indicates even more cash remains in the buyer's pocket instead of going to the lender, giving long-term economic benefits.

Additionally, lower interest prices can enhance the buyer's general economic wellness by potentially reducing the overall amount paid for the automobile. With more workable monthly repayments and minimized rate of interest expenses, customers can appreciate their brand-new vehicle without being monetarily stressed. This makes automobile funding with reduced rates of interest a affordable and smart option for customers looking to make a sound investment in their transport needs.

Flexible Settlement Options

One attractive feature of automobile funding is the capacity to select from a selection of versatile repayment options tailored to fit specific monetary situations. These choices give debtors with the freedom to pick a payment plan that aligns with their spending plan and income circulation. One usual adaptable repayment option is the option between set and variable rates of interest. Dealt with rates use stability as the regular monthly payments remain continuous throughout the financing term, making budgeting easier. On the various other hand, variable rates might change based upon market problems yet can potentially supply lower preliminary prices. Additionally, lenders commonly permit debtors to select the car loan term length, with longer terms resulting page in lower monthly payments however greater total rate of interest expenses. Some funding intends also supply the opportunity of making bi-weekly or accelerated payments to reduce the finance period and decrease interest costs. The accessibility of diverse payment alternatives equips people to handle their automobile funding in such a way that best matches their economic situation.

Improved Credit Report Rating

Enhancing your credit history through automobile financing can open doors to better financial possibilities and positive financing terms in the future. Making prompt payments on your auto financing demonstrates to financial institutions that you are a liable debtor, which can bring about a boost in your credit report with time find out (ford finance morris). A higher credit rating not only reflects positively on your financial practices however also offers you accessibility to far better rates of interest and lending terms when you obtain future credit score, such as home mortgages or individual finances

Moreover, an improved credit rating can likewise assist you receive superior bank card with reduced interest rates and much better benefits, supplying you with added economic benefits. Lenders are most likely to trust individuals with a background of managing debt properly, making it much easier for you to secure funding for significant purchases in the future. By utilizing car funding to increase your credit rating score, you are purchasing your economic health and setting on your own up for success in the future.

Accessibility to New Automobiles

By developing a solid credit score background via responsible monitoring of a vehicle loan, people can get to a larger selection of brand-new vehicles from reliable car dealerships. Having an excellent credit report rating opens doors to much more favorable funding alternatives and terms, permitting purchasers to manage higher-end versions or vehicles with innovative features. With improved credit reliability, individuals might get approved for lower rate of interest, decreasing the total cost of buying a new vehicle.

Accessibility to brand-new cars additionally means accessibility to the most current security modern technologies, enhanced fuel efficiency, and improved driving experiences. More recent lorries usually include guarantee coverage, supplying comfort versus unexpected repair work. On top of that, staying present with automobile modern technology can lead to enhanced resale value in the future.

Additionally, trustworthy dealerships may use promos and motivations exclusively to customers with strong credit history backgrounds. These perks can range from cash discounts to affordable funding rates, even more sweetening the offer for those with great credit score standing. Inevitably, the capacity to access brand-new automobiles via auto funding incentives responsible economic behavior and opens up opportunities for driving a remarkable, a lot more trusted car.

Conclusion

To conclude, vehicle financing provides countless advantages such as lower rate of interest, flexible settlement options, enhanced credit report, and access to new next page vehicles. It supplies individuals with the opportunity to buy a cars and truck without having to pay the sum total upfront, making it a affordable and convenient alternative for many customers. By understanding the benefits of vehicle funding, individuals can make educated choices when it pertains to acquiring an automobile.

When taking into consideration the advantages of automobile funding, possible buyers can utilize adaptable repayment options and access to a bigger variety of cars than with straight-out purchases. One of the main benefits of auto financing is the capacity to spread out the expense of a vehicle over time with month-to-month installments, making it a lot more affordable for individuals who may not have the funds offered for a straight-out acquisition.Benefiting from lower interest rates is an essential benefit of vehicle financing, allowing buyers to conserve on overall prices and make their car purchase much more monetarily feasible. Ultimately, the ability to access new cars with vehicle financing incentives accountable monetary behavior and opens up possibilities for driving a premium, much more reputable vehicle.

In conclusion, automobile financing uses countless advantages such as lower rate of interest rates, flexible settlement options, enhanced credit history scores, and access to brand-new lorries.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Katie Holmes Then & Now!

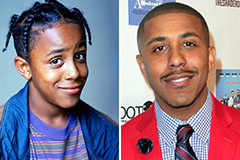

Katie Holmes Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!